Which Is The Most Liquid Form Of Money

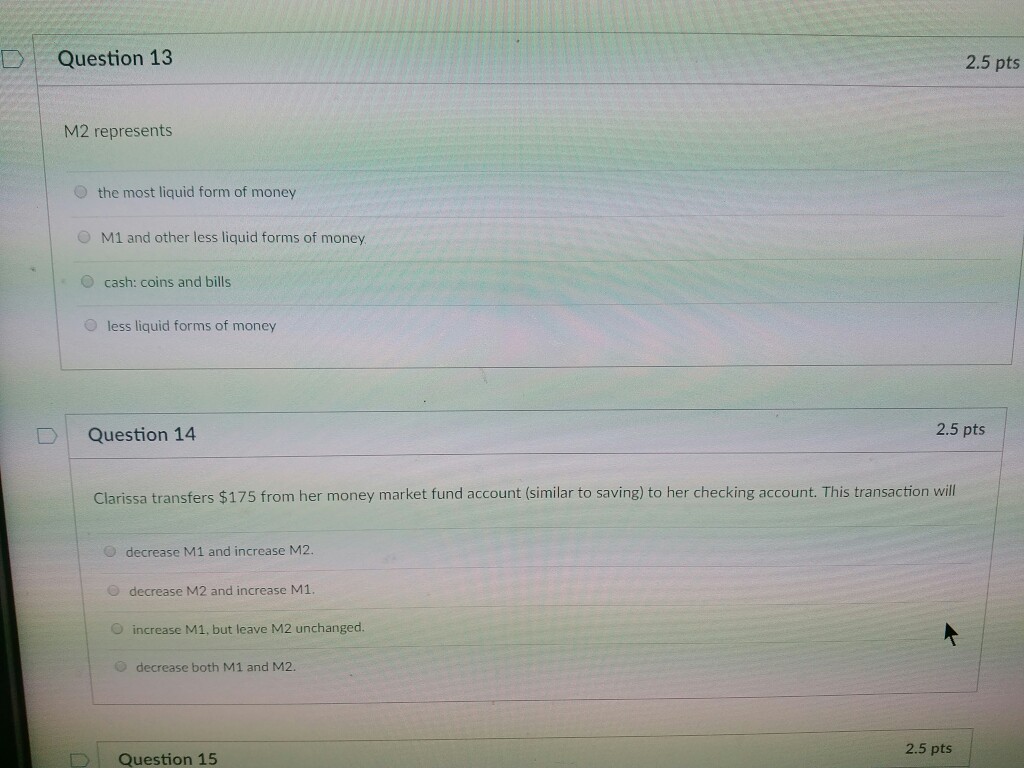

Which Is The Most Liquid Form Of Money - (a) checking account checking accounts is the most liquid as you can withdraw money whenever an account holder wants. The demand for passive balances is related to the choice between keeping money and bonds. Liquidity, in its literal form, refers to the condition when there is a flow of something. Which of the following is most liquid? Other forms have their prevalence in liquidity as per their conversions into cash. A liquid asset is an asset that is easy to be converted into cash in a relatively short time. Among potential stores of value, money:

Liquidity, in its literal form, refers to the condition when there is a flow of something. (a) checking account checking accounts is the most liquid as you can withdraw money whenever an account holder wants. A share in a publicly traded company, the funds in a money market account, a painting, and a $50 bill. Among potential stores of value, money:

And, the number of loans decreases, so, consequently,. By changing the policy interest rate in south africa at which private banks borrow money from the sarb. Has the advantage of being the most liquid asset. A liquid asset is an asset that is easy to be converted into cash in a relatively short time. Which of the following is most liquid? Money is the most liquid form in which wealth can be kept but earns no interest whereas bonds provide a return but are less liquid.

And, the number of loans decreases, so, consequently,. Has the advantage of being the most liquid asset. Liquidity, in its literal form, refers to the condition when there is a flow of something. Which one of the following statements is incorrect? The sarb influences the quantity of money in the economy:

Increases in value during periods of inflation. A share in a publicly traded company, the funds in a money market account, a painting, and a $50 bill. By changing the policy interest rate in south africa at which private banks borrow money from the sarb. Cash is the most liquid form of money.

Money Is The Most Liquid Form In Which Wealth Can Be Kept But Earns No Interest Whereas Bonds Provide A Return But Are Less Liquid.

And, the number of loans decreases, so, consequently,. In economics, liquidity implies that the money flows into the economy and among all the forms, cash is considered to be the most liquid form of money. The demand for passive balances is related to the choice between keeping money and bonds. Increases in value during periods of inflation.

Liquidity, In Its Literal Form, Refers To The Condition When There Is A Flow Of Something.

Which one of the following statements is incorrect? Ideally, the fact that cash can easily be converted to assets is the reason behind its liquidity. There is no limitation on money. Money is essential because it is an exchange medium that facilitates the development and growth of national and international economies.

Which Of The Following Is Most Liquid?

Cash is the most liquid form of money. Since most nations use different currencies, exchange rates are implemented in international trade to enhance transactions efficiency for businesses and individuals participating in foreign trade. Offers the highest rate of return. Liquid assets are essential in a company since they are used to pay current obligations, but at the same time, having much liquidity reduces a business's profitability.

A Share In A Publicly Traded Company, The Funds In A Money Market Account, A Painting, And A $50 Bill.

By changing the policy interest rate in south africa at which private banks borrow money from the sarb. Has the advantage of being the most liquid asset. Provides more services than other assets. Other forms have their prevalence in liquidity as per their conversions into cash.

A liquid asset is an asset that is easy to be converted into cash in a relatively short time. Provides more services than other assets. Other forms have their prevalence in liquidity as per their conversions into cash. Which of the following is most liquid? By increasing the repo rate, leading to an increase in the interest rate on loans to bank clients;

:max_bytes(150000):strip_icc()/Term-Definitions_LiquidAsset-0527b522ceba4808bd4fd02e2b69c64d.jpg)