Schedule G Form 1120

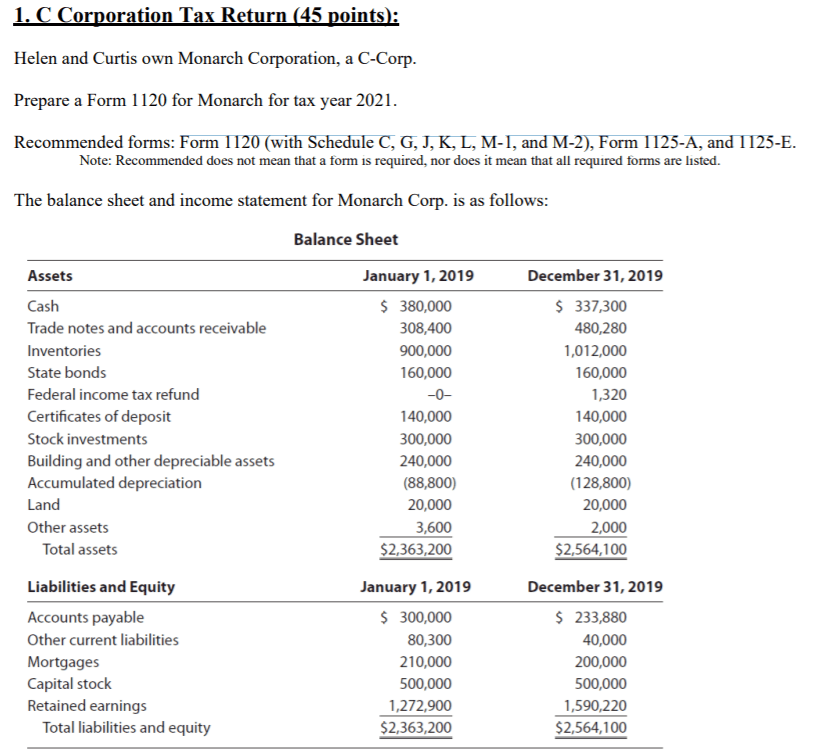

Schedule G Form 1120 - Corporation income tax return, and its accompanying schedules, including what each tax form is for and. Classes of the corporation’s stock entitled to vote? Corporation income tax return, to report the income, gains, losses, deductions, credits, and to figure the income tax liability of a corporation. Who must file every corporation that answers “yes” to form 1120, schedule k, questions 4a or 4b, must file schedule g to provide the additional information requested for certain entities,. Form 1120 schedule g reports on certain transactions and relationships a corporation has with other entities or individuals. I've gone through every checkbox and field under screen 4.1 >. Learn how to access and complete schedule g (form 1120) for corporations that have certain entities, individuals, or estates owning their stock.

Learn how to access and complete schedule g (form 1120) for corporations that have certain entities, individuals, or estates owning their stock. Income tax return for corporations. It is attached to form 1120, the u.s. Find irs instructions and links.

Enter the combined tax on line 1. It helps capture information related to parent. Schedule g is included with your form 1120 filing if you have shareholders that own more than 20% of the voting stock in a corporation. Schedule g is one of the schedules that domestic corporations use to report their income, gains, losses, deductions, credits, and income tax liability on form 1120. Check if the corporation is a member of a controlled group (attach schedule o (form 1120)). Find irs instructions and links.

Learn how to access and complete schedule g (form 1120) for corporations that have certain entities, individuals, or estates owning their stock. Who must file every corporation that answers “yes” to form 1120, schedule k, questions 4a or 4b, must file schedule g to provide the additional information requested for certain entities,. Schedule g is included with your form 1120 filing if you have shareholders that own more than 20% of the voting stock in a corporation. I've gone through every checkbox and field under screen 4.1 >. Find irs instructions and links.

It is attached to form 1120, the u.s. Corporation income tax return, to report the income, gains, losses, deductions, credits, and to figure the income tax liability of a corporation. I've gone through every checkbox and field under screen 4.1 >. Learn how to access and complete schedule g (form 1120) for corporations that have certain entities, individuals, or estates owning their stock.

Check If The Corporation Is A Member Of A Controlled Group (Attach Schedule O (Form 1120)).

Corporation income tax return, to report the income, gains, losses, deductions, credits, and to figure the income tax liability of a corporation. This guide will give you a better understanding of form 1120, u.s. Schedule g is included with your form 1120 filing if you have shareholders that own more than 20% of the voting stock in a corporation. It helps capture information related to parent.

Form 1120 Schedule G Reports On Certain Transactions And Relationships A Corporation Has With Other Entities Or Individuals.

Classes of the corporation’s stock entitled to vote? Go to the input return tab. Proconnect tax will automatically carry your entry in percentage of common stock owned for each individual to the schedule g. Enter the combined tax on line 1.

I Can't Find The Field That Will Change Schedule K, Question 4A To Yes, Which Should Then Generate Schedule G.

It is important to hi. Find out who needs to. Income tax return for corporations. Corporation income tax return, for corporations with significant shareholders or voting power.

On Form 1120, If A Foreign Entity Owns 100%, Where Is That Information Provided To The Irs On The Questions/Schedules

Shares of the company that have never been issued or were bought back from a shareholder by the company are known as treasury shares. those shares have no voting. Learn how to access and complete schedule g (form 1120) for corporations that have certain entities, individuals, or estates owning their stock. I've gone through every checkbox and field under screen 4.1 >. Learn how to fill out schedule g, an extension of form 1120, the u.s.

Schedule g is one of the schedules that domestic corporations use to report their income, gains, losses, deductions, credits, and income tax liability on form 1120. This guide will give you a better understanding of form 1120, u.s. Enter the combined tax on line 1. Schedule g is included with your form 1120 filing if you have shareholders that own more than 20% of the voting stock in a corporation. On form 1120, if a foreign entity owns 100%, where is that information provided to the irs on the questions/schedules